Blog News

Stay Up To Date With News And InformationHow Olathe Seniors Can Start and Succeed in House Flipping

Guest Blog post by Kayla Harris of Elder Impact Succeed in House Flipping Olathe seniors looking for steadier retirement income through real estate often see the promise of house flipping opportunities for seniors, then hesitate at the real risks. The core...

Starting a Small Farm: From First Steps to Finding Profit

Image: Freepik Guest blog post by Carleen Moore Starting a Small Farm There’s something raw and grounding about the idea of starting your own farm. No cubicles. No constant pings. Just space, dirt, tools, and time. But make no mistake — farming isn't simple. It’s not...

How to Avoid the Most Costly Life Insurance Missteps

Guest Blog by Denise Long of GrandMothering.info Life Insurance Missteps Life insurance seems straightforward until you realize how easy it is to get it wrong. You assume you’re covered. You figure your workplace policy is enough. You trust you’ll “get to it” once...

Your First Investment Property? Avoid Mistakes and Build Equity From Day One

Image via Pexels Guest Blog Post by Denise Long of Grandmothering.info Your First Investment Property So you’re thinking about buying your first investment property. Good. The market doesn’t wait, and neither should you. But if you’re treating this like buying your...

Smaller Space, Smarter Life: How Downsizing Clears the Way Forward

Guest Blog post by Denise Long of grandmothering.info Smaller Space, Smarter Life There’s a moment, usually after standing in a room you never use, looking at stuff you forgot you owned, when downsizing starts to make sense. Not just as a way to declutter, but as a...

Increased Importance of a Gap Plan in 2026

Gap Plan in 2026 Health insurance in the U.S. is changing fast — and not always in ways that help families. With premiums climbing, deductibles creeping higher, and uncertainty about whether ACA subsidies will continue, many Americans are being nudged into lower-cost,...

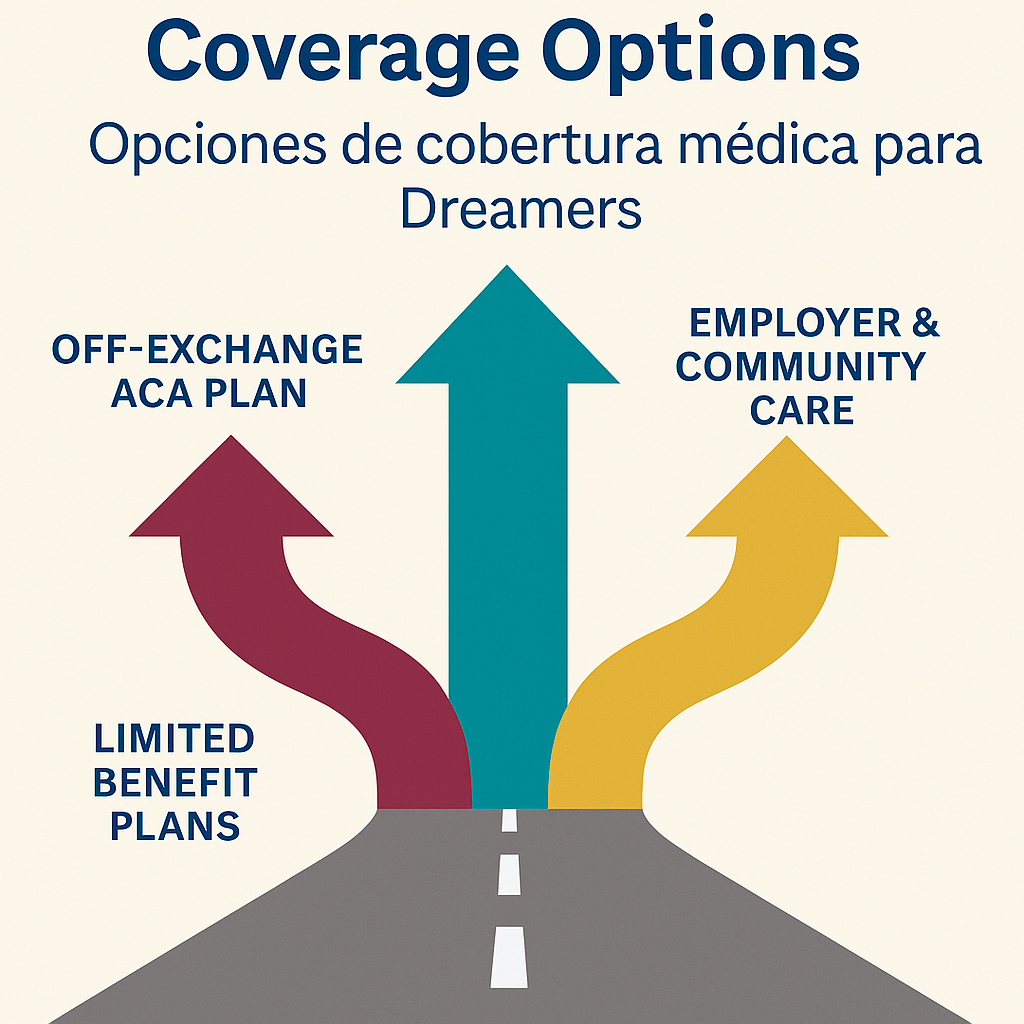

Health Coverage Options for DACA in 2026

Health Coverage Options for DACA Recipients & Dreamers in Kansas and Missouri: Navigating 2026 Without the Marketplace Understanding the Challenge In August 2025, federal rules changed that prevent DACA recipients (“Dreamers”) from enrolling in health plans...

Major Medical Alternatives: Exploring Indemnity and Limited Benefit Plans in Kansas City

Major Medical Alternatives When most people think about health insurance, their first thought is major medical coverage — the type of plan offered by employers or through the Affordable Care Act marketplace. These plans are comprehensive and cover a wide range of...

GoFundMe for Medical Bills

Why So Many Everyday Americans Turn to GoFundMe for Medical Bills (and How You Can Avoid It) "It’s not the illness that breaks families — it’s the bills that follow." Every day, millions of Americans wake up believing their health insurance will protect them. Then the...

Affordable Renter’s Insurance in Olathe, Overland Park and Lenexa

Why Renter’s Insurance Is Cheaper (and More Important) Than You Think “I don’t own much — why would I need renter’s insurance?” It’s a common myth — and one that can cost you thousands if the unexpected happens. Whether you're renting a downtown apartment in Overland...

When Life Changes, So Should Your Insurance — Here Are 5 Situations to Review

When Life Changes Life moves in seasons — and your insurance should keep up. Whether you just got married, welcomed a new baby, changed jobs, or moved into a new home, these moments don’t just shift your lifestyle — they impact your financial protection too. If you're...

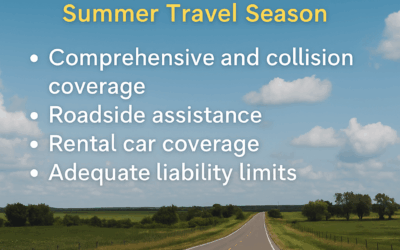

5 Auto Insurance Tips for Summer Road Trips – Olathe, Overland Park, Lenexa

5 Auto Insurance Tips - Summer is the perfect time to roll down the windows, crank up the tunes, and hit the open road. But before you head off on that weekend getaway or family vacation, make sure your auto insurance is as ready as your travel playlist. Here in...

Common Insurance Gaps in Olathe, Overland Park & Lenexa

Insurance Gaps That Could Cost You Thousands — and How to Avoid Them Common Insurance Gaps. Most people assume their insurance will have them covered when something unexpected happens. But unfortunately, that’s not always the case. Here in Olathe, Overland...

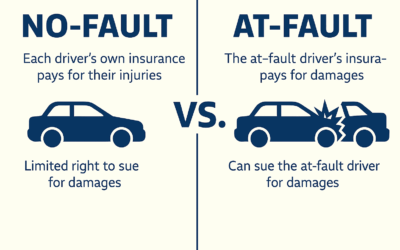

No-Fault vs At-Fault Auto Insurance

No-Fault vs. At-Fault Auto Insurance: What Every Driver Should Know No-Fault vs At-Fault Auto Insurance. Understanding the impact on your coverage, claims, and costs in Kansas and Missouri If you’ve ever been involved in a car accident—or even just shopped...

Storm Season Insurance Tips for Olathe, Overland Park and Lenexa

June means one thing in Kansas — storm season is here.Storm Season Insurance Tips.- And if you live in Olathe, Overland Park, or Lenexa, you’ve probably already seen the lightning shows, heavy downpours, and local weather alerts that come with it. But what many...

5 Life Insurance Underwriting Predictions For 2025

5 Life Insurance Underwriting Predictions For 2025 - Guest post by Sarah M. of Sanitair LLC So, grab your favorite drink, settle into your comfiest chair, and let’s chat about what’s coming around the corner in life insurance underwriting for 2025. You know how...

What is Business Owners Insurance and Why It’s Important for Your Small Business

What is Business Owners Insurance and Why It's Important for Your Small Business Running a small business is no small feat. Whether you're managing inventory, handling payroll, or marketing your services, there’s always something demanding your attention. One thing...

The Hidden Costs of Skipping Life Insurance: What You Can’t Afford to Ignore

Skipping Life Insurance In the hustle and bustle of everyday life, it’s easy to put off thinking about life insurance. Maybe you’re healthy, young at heart, and focused on more immediate financial goals like buying a home, saving for your kids’ education, or planning...