Life & Final Expense Insurance

Protect what is most important

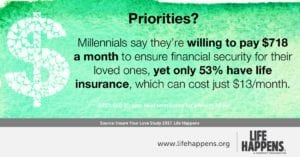

The best time to buy life or final expense insurance is when you are young and healthy. Many believe life insurance is too expensive. Truthfully, many overestimate the cost of life insurance.

According to Life Happens, 2 in 3 adults think life insurance is too expensive, but most overestimate the true cost by more than 3 times.

Depending on your situation you have choices with life insurance options. You can either choose a term life option or whole life. What are the differences? Let’s take a closer look.

Term Life Insurance is life insurance for a designated time period (Term) and is

Whole Life Insurance is life insurance that over time builds a cash value. These types of policies are meant to be kept over a lifetime and the accumulated cash value can be borrowed for reasons like college tuition, down payments on a new home or auto.

Final Expense Insurance

Final Expense Insurance is used for what the name implies. It can be used to pay the burial and funeral costs so your loved ones don’t have to worry about

If you have questions please contact me and we can discuss your life & final expense insurance needs.

New !! Now you can run a Final Expense Quote Here: