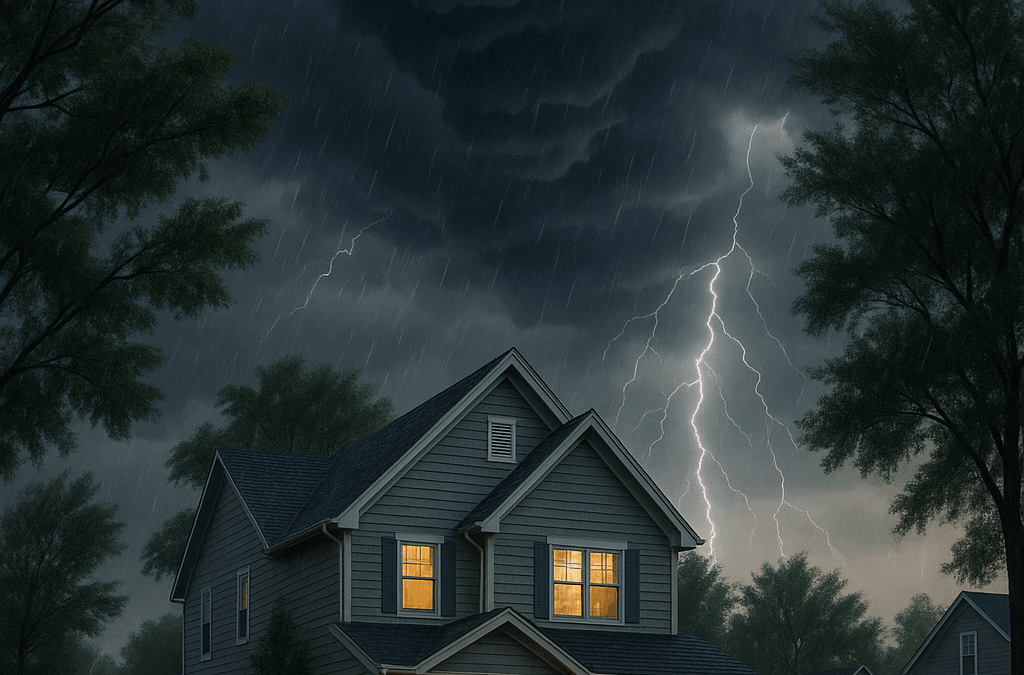

June means one thing in Kansas — storm season is here.

Storm Season Insurance Tips.- And if you live in Olathe, Overland Park, or Lenexa, you’ve probably already seen the lightning shows, heavy downpours, and local weather alerts that come with it.

But what many homeowners don’t realize is that not all insurance policies automatically cover the kinds of storm-related damage we face every year — things like hail, wind, fallen trees, and even temporary displacement from your home.

Here’s what you need to know to protect your property and your peace of mind before the next thunderstorm rolls through.

What Should Your Homeowners Policy Cover?

1. Wind and Hail Damage

Hail is one of the most common and costly causes of home damage in Johnson County. Make sure your policy covers roof repairs and siding replacement — especially important in Olathe and Lenexa where open spaces mean more exposure.

2. Water Damage — But Not Flooding

Storm runoff and flash floods can cause serious damage, but standard home insurance doesn’t cover flooding. You’ll need a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

3. Detached Structures and Fences

Garages, sheds, or fences? Check your coverage limits. These often have separate caps, and a major Kansas windstorm can easily topple an old fence.

4. Additional Living Expenses (ALE)

If your home is unlivable after storm damage, this coverage helps pay for hotel stays, meals, and temporary housing. A must-have for families in suburban areas like Overland Park with longer repair timelines.

Does Your Auto Insurance Cover Storm Damage?

If a tree branch smashes your windshield or hail batters your car, you’ll need comprehensive auto coverage — not just liability. Comprehensive protects your vehicle from non-collision damage, like weather-related incidents.

Many drivers skip this to save money, but in storm-prone areas like ours, it’s often worth the extra peace of mind.

⚠️ Local Tip: Check Your Deductibles Before Storm Season

In some Kansas policies, hail or wind damage may carry a separate deductible — often a percentage of your home’s value. That can be a surprise when you’re filing a claim after a June thunderstorm. Let’s review your deductible options together.

✅ Time for a Policy Check-Up?

If you’re unsure whether you’re protected, now’s the time to review your coverage. TCG Insurance Solutions is based right here in Olathe, and we work with clients across Overland Park and Lenexa every day.

We’ll help you understand your current policy, identify any gaps, and recommend affordable options from multiple carriers — because your safety shouldn’t depend on guesswork.

Call Paul Today at (913) 390-3220 or Request a Free Coverage Review

Don’t wait until after the storm. Let’s make sure you’re covered before it hits.