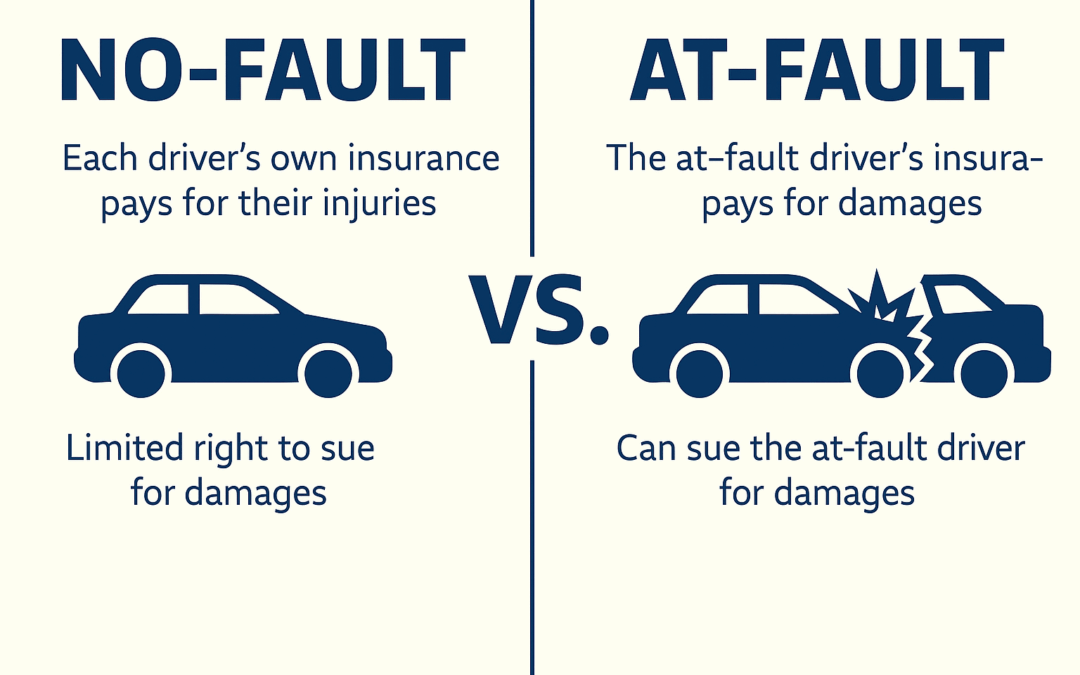

No-Fault vs. At-Fault Auto Insurance: What Every Driver Should Know

No-Fault vs At-Fault Auto Insurance. Understanding the impact on your coverage, claims, and costs in Kansas and Missouri

What is a No-Fault Insurance State?

In a no-fault insurance state, your own insurance company pays for your medical bills and related expenses after an accident—regardless of who caused the crash. This is handled through Personal Injury Protection (PIP) coverage.

- Each driver files a claim with their own insurer

- PIP pays for medical expenses, lost wages, and essential services

- Lawsuits are limited unless injuries are serious

Kansas is a no-fault state, along with Florida, Michigan, and others.

What is an At-Fault Insurance State?

In an at-fault or tort-based system, the driver who is legally responsible for the accident must pay for the damages. The insurer of the at-fault driver covers the cost of repairs, injuries, and other losses.

- Claims are made against the responsible driver’s insurance

- You can sue for pain, suffering, and full damages

- Determining fault can delay the process

Missouriis an example of an at-fault state.

Pros and Cons of Each System

No-Fault Insurance

Pros:

- Faster claims process

- Reduced legal battles

- Guaranteed medical coverage with PIP

Cons:

- Limited right to sue

- Potentially higher premiums

- Limited compensation for pain and suffering

At-Fault Insurance

Pros:

- Right to recover full damages

- Driving history has greater impact on rates

- More coverage customization options

Cons:

- Slower claim resolution due to fault investigation

- Greater legal exposure

- No guaranteed medical payments if at fault

Local Insight: Kansas vs. Missouri

Olathe drivers are uniquely positioned near the Kansas-Missouri border, meaning you may drive in both no-fault and at-fault states. If you live in Kansas but are in an accident in Missouri, different rules may apply for coverage and claims.

Understanding these laws ensures you’re not caught off guard—and that you’re carrying the right type of coverage for your driving habits.

Conclusion

There’s no perfect system—both no-fault and at-fault laws have their benefits and drawbacks. The key is knowing how your state handles claims and making sure your policy is designed to protect you no matter what side of the line you’re on.

At TCG Insurance Solutions, we help drivers in both Kansas and Missouri find affordable, reliable car insurance that fits their needs and budget. If you’re searching for cheap car insurance in Olathe, give us a call at 913-390-3220 or fill out the form below for a free quote today.